SMART INVESTMENTS…

SMART RETURNS

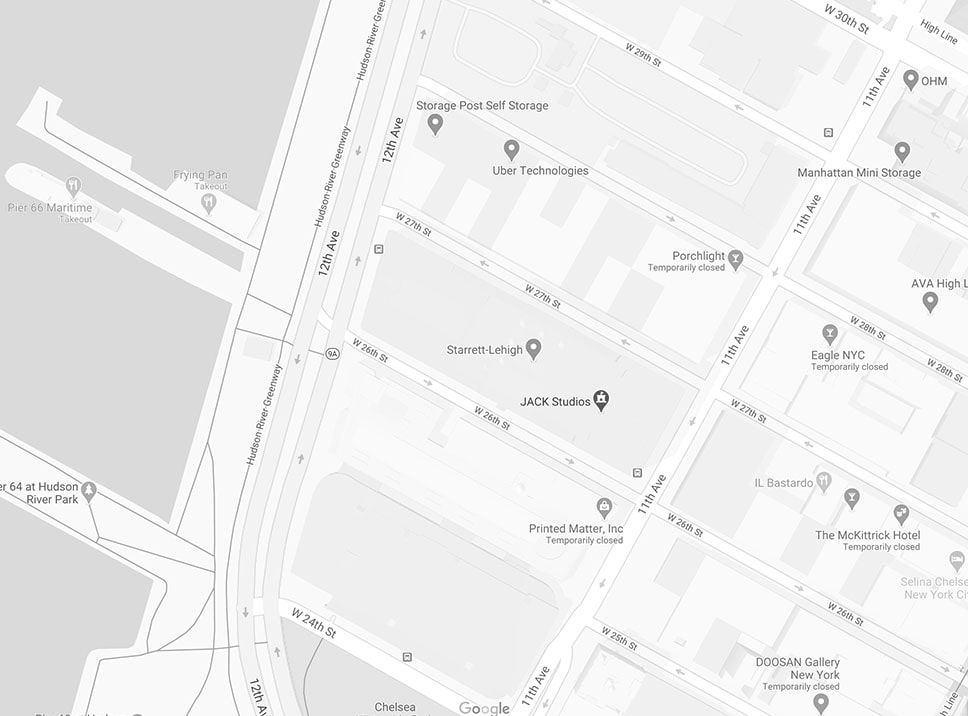

In August 1998, 601W successfully outmaneuvered thirty competitors for the Starrett-Lehigh Building, a 2.3 million square feet manufacturing and warehouse behemoth with a unique landmarked architectural design. The building had substantial vacancies (50%) and sizable operating losses.

SUCCESS STORY

$800 MILLION PROFIT

SOLD

- SQUARE FOOTAGE 2.3M

- PURCHASE PRICE $151.5M

- SALE PRICE $950M

- RETURN ON INVESTMENT 103% PA

- HOLDING PERIOD 13 YRS

601W’s vision was to creatively transform the dated manufacturing building, which was located in an unsafe and deserted neighborhood in the far west side of Manhattan, into a new media and technology center that would then attract millennial tenants with rental rates at five times its then current average of $5/foot. With a dramatic design and vast infrastructure changes and improvements, 601W completely transformed Starrett-Lehigh into what is today: one of the premier new media buildings in Manhattan that helped redefine the West Chelsea area as one of the choicest neighborhoods in New York City. Starrett-Lehigh today is the epicenter of the gentrification and rehabilitation that has occurred in the entire West Chelsea neighborhood, with many world-renowned tenants in the media and design industries. The Property was refinanced twice within five years of acquisition, and eighteen months after the second refinance the principals of 601W sold a 49.9% interest in the building at a value that was triple its original price! In 2011 the Property was sold for $950 million, which was $800 million more than 601W’s acquisition price!